Forex Trading

Multi-Stock Trading: Forex trading for the experts

Advantages of forex trading with Multi-Stock Trading

One platform with multiple instruments and markets

With us as your broker, you can use one platform for forex trading as well asfor indices, commodity CFDs and cryptocurrency CFDs.

You're trading with a regulated broker

MultiStock is a financial services company regulated by the Autonomous Island of Moheli, ensuring compliance with local financial laws.

Highly

customisable

Customizable to your individual trading style and strategies, meaning you are in complete control of your trading.

Access to automated trading

You have the choice to download and use ready-made scripts and expertadvisors or create a custom indicator or script, based on your very own trading strategy.

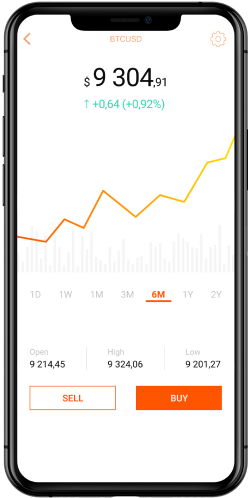

Access anytime, anywhere

Trade via the desktop, web-based or mobile version of the MetaTrader 5 trading platforms. The web-based version is particularly useful for Apple Mac users,where a direct download is not available.

Access to a wide range of analysis

50+ built-in indicators and graphic tools for technical analysis,quotes history center, strategy tester and news, all designed to helpyou increase your trading knowledge.

Forex

Setting measurable goals in a volatile market

Whether you’ve been trading for a year or have decades of experience behind you, it’s vital to set yourself quantifiable goals before you begin. That could be achieving a 20% annual return on your investment or getting a total of 100 pips a month – whatever your goal, it should be easily measured.

How does forex trading work?

The risks and rewards of the forex market

Another of the key risks to consider is that some forex pairs are much more volatile than others, and pairs that include USD are often in high demand making them more liquid than others.

To gain the rewards and profits you may be looking for, you need to have a full understanding of all risks involved in trading and the forex market.

Expert trading for expert traders at Multi-Stock Trading

MetaTrader 5 is one of the best forex trading platforms in the world, with a range of major, minor and emerging currency pairs for you to go long or short on, as well as forex charts and other useful tools like an economic calendar. Why not get in touch with our team today to access a live account. Offering you the ability to trade in over 50 forex markets, 24 hours a day from Sunday night until Friday night, discover for yourself why so many experts trade with Multi-Stock Trading.

Why do people trade forex?

People trade on the forex market for a number of different reasons. The foreign exchange markets are the largest and most liquid financial markets in the world, making them immensely popular among forex brokers and traders. Forex trading exploded in popularity because of its leverage,continual trading opportunities, high liquidity and low entry costs.

What is a forex broker?

After the 1970s, when the United States dropped the Bretton Woods agreement regarding the USD convertibility in gold,the foreign exchange market grew dramatically. First available only to institutional players due to the high transaction costs and difficulty to access, it all changed when the internet and online trading appeared. Forex brokers made it possible for the retail trader to join the largest financial market in the world.

A forex broker is an intermediary link between the trader and the market. It offers market quotes via its various liquidity providers, and its trading platform reflects the best possible conditions it has to offer to its customers. For this, it charges a fee or a commission, and its interests align with those of the trader.

Brokers are organised as either a dealing desk (also called market makers) or a non-dealing desk. A dealing desk creates a market by mirroring the quotation from the interbank market and deals the prices to its clients. In non-dealing desks, forex brokers route their clients’ orders to the liquidity provider, and the best quote is offered to retail clients from the liquidity pool.

Brokers organised like non-dealing houses often offer ECN (Electronic Communication Network)or STP (Straight-Through Protocol) execution. However, different types of forex brokers exist, mixing dealing with non-dealing conditions, and operating as hybrid entities.

Depending on the type of the brokerage house, different account types exist. ECN accounts and STP accounts are just a couple of examples.

What factors move the forex market?

Because the forex market is made up of currencies from across the globe, predicting exchange rates is difficult as there are a number of factors that constantly move prices. The main driving factors for these moves are central banks, news reports and market sentiments. Understanding how each of these operate will help you on your trading journey.

It’s also important to remember that prices move up and down based on supply and demand,just like any other financial market. As a forex trader, you’re likely to either choose toput your money into an economy that has strong growth potential or short a market.

How to define success as a forex trader?

No matter if you’ve been trading for a short or long time, defining your success will help youto become an expert trader. Think about what you want to achieve from it and how you personallyd efine success.

Setting goals is vital and these should be easy to measure. It’s also recommended you seta target that can be achieved over a long timeframe, annually for example, as opposed to monthly. Once you’ve established these factors, you’ll be able to put your action plan into work.

Regardless of how experienced you are, it’s important to always manage your expectations throughout the forex trading process, and control your emotions. To become a successful trader, you must understand the mechanics of the forex market, trust your analysis and follow the rules of your forex trading strategies.

Open a forex trading account

with Multi-Stock Trading